Report a scam to the Federal Trade Commission - 1-877-382-4357 or ftc.gov/complaints

10-25-2021

WCCU is aware of fraudulent charges that members may have received on their debit cards. These fraudulent charges are NOT limited to only WCCU members; other financial institutions and credit card companies are reporting similar fraudulent transactions affecting their customers.

Please contact our Fraud Department at 866-279-1399 with any questions and fraudulent charges on your WCCU accounts

01-23-2020: IMPORTANT: FRAUD ALERT

WCCU Members: We have been alerted from CUAD about the following dangerous situation happening in North Dakota. It is important to share this information with you. Please read:

The Credit Union Association of the Dakotas (CUAD) has been contacted by David Goodman, Detective with the Minot Police Department, to pass along a warning our credit unions about new Felony Lane Gang activity in Minot, Fargo, Grand Forks, and West Fargo. Please be sure to alert the necessary staff regarding this activity. Detective Goodman provided the following contact information and message:

“Just a heads up, Fargo and Grand Forks are starting to see similar crimes/activity that lead them to believe that the Felony Lane Gang (FLG) activity may be starting up again in North Dakota. At this time, we don’t have a whole lot of additional information other than the smash and grab style vehicle break ins are starting to occur again where wallets and purses are being stolen. Suspects are then showing up at bank/credit union drive throughs with the stolen I.D.’s and bank/credit union creds. Please push this information out to your members so we can all be as vigilant as possible if they come through our areas.”

01-21-2020: Consumer Fraud

Officials have charged two people described as "Irish Travellers" in racketeering and other felony charges for targeting ranchers and other rural residents in construction fraud, with one victim alleged to have been scammed of $1.89 million.

State and county law enforcement investigators on Jan. 17 in McLean County District Court filed papers charging Sean Patrick Gorman, 26, and Bartley Gorman Jr., 55, with various Class B and Class C felonies.

Sean Patrick and Bartley Gorman Jr. both were charged with a Class B felony — illegally conducting an enterprise and a Class C felony, exploitation of a "eligible adult." An eligible adult," means someone 65 years or older, or could be someone with a disability. In addition. Sean Patrick Gorman also was charged with attempted theft of property, another Class B felony. Each Class B felony carries a maximum penalty of 10 years in prison. Class C felonies are five years in prison.

As the affidavit was filed, North Dakota Attorney General Wayne Stenehjem on Jan. 17 issued a cease and desist order against the two men and "as many of the aliases as we can determine," he said.

"It's unbelievable," Stenehjem said. "This is the most widespread example of consumer fraud in the construction realm that we've seen — a traveling group of people who roam the country to scam people."

The attorney general said he hoped publicity would help alert "likely victims" to contact his office, at 800-472-2600. He said it may be hard to get people's money back but he wants to make sure any victims, or potential victims, are aware.

In addition to the rancher allegedly out $1.89 million, the investigation found a number of separate five- and six-figure frauds.

In the affidavit, North Dakota Bureau of Criminal Investigation agent Matt Hiatt and McLean County detective Aaron Matties write that the Gormans are part of a larger, long-standing organized crime group called "Travellers," "Irish Travellers," "The Irish Mob," or the "White Gypsies." (Traveller with the double "l" is the British English spelling of the word.) The investigators say the two previously were involved in a widespread roofing scam that members of the group perpetrated on elderly people in Oklahoma.

In North Dakota, Hiatt and Matties said the Gormans and their Gorman General Contracting company, based in the Minot area, carried out a "pattern of racketeering activity," and used "deception and intimidation" to extort victims in home and ranch construction projects.

According to the complaint, they repeatedly would "just show up" and start working, demanding payments that third party experts deemed "exorbitant in relation to the work or supplies." The poor quality work would often lead to future projects and extortion. In other instances, they would show up and offer a low price for projects and later escalate the costs.

Hiatt and Matties say The Travellers "appear to be focusing on elderly victims, in home and ranch construction projects." Victims include Native American elders. According to the court documents, if the victim pays once, the Gormans re-appeared to "bleed more money" out of their victims.

More in-depth details can be found on AgWeek.com.

8-07-19: SCAM ALERT

Car Wrap/Decal Scam

WCCU has been alerted about a scam happening in our regions.

A "company" or person advertises online-- Facebook or other social media, or sometimes even on job board sites. They may even send you a direct message. They promise easy money if you shrink-wrap your car with ads for brands, or put decals on your vehicle, advertising for a product or business. The "company" behind the ads says all you have to do is deposit a check, use part of it to pay a specified shrink-wrap or decal vendor, and drive around like you normally would.

But, don't jump onto the bandwagon. It is only easy money for the scammer who placed the ad or post.

How the scam works:

The message says you will make a couple hundred bucks. But when they "company" send you a check, it is for much more than that-- a couple thousand dollars (typically under $3,000) They tell you to deposit the check, keep part of it as your share, and wire the rest of the money to another company--the shrink-wrap or decal company that will wrap your car.

Weeks after you wire the money, the check bounces and your bank or credit union tells you it was fake. The money you kept as "your share" disappears, and the money you wired is long gone-- no getting it back. On top of that, you're on the hook for paying your financial institution back for the fake check! And, of course, no one is wrapping your car.

How you can tell it's a scam:

If you get a message urging you to deposit a check and wire money back, it is a scam. Every time. No matter the story. And if this were a legitimate car wrap opportunity, wouldn't the company directly pay the car-wrapping/decal vendor, instead of asking you to do it?

If this has happened to you, file a complaint: ftc.gov/complaint

6-14-19: SCAM ALERT

WCCU members:

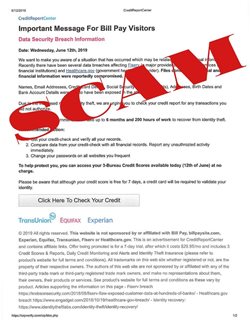

If you have received this message pop up on CU Pay Bills, DO NOT CLICK on anything! It is a SCAM.

1-31-19- LOCAL SCAM REPORTED:

MORTON COUNTY, N.D. - The Morton County Sheriff's Department is warning about a phone scam that almost paid off.

It says a Bismarck woman was a target of a fake kidnapping and ransom phone call. The call came from a Florida number.

When she answered, she heard someone in the background crying and upset, yelling for help, saying he was being beat up.

The caller said they had her son and she needed to stay on the line and go to Walmart to wire $5,000 to free her son.

Because her son does live in Florida, she thought it could be legitimate and was preparing to meet the demands. But her co-worker called the son's phone and found out he was at work and fine.

Authorities say beware of such scams from unfamiliar numbers, especially since they didn't use her son's phone.

ONLINE DATING SCAMS

Here is how they work:

You meet someone special on a dating website. Soon he wants to move off the dating site to email or phone calls. He tells you he loves you, but he lives far away--maybe for business, or because he is in the military.

Then he asks for money. He might say it is for a plane ticket to visit you. Or emergency surgery. Or something else urgent.

Scammers, both male and female, make fake dating profiles, sometimes using photos of other people--even stolen pictures of real military personnel. They build relationships--some even fake wedding plans-before they disappear with your money.

Here is what you can do:

Stop. Do not send money. Never wire money, put money on a prepaid debit card, or send cash to an online love interest. You will not get it back.

GRANDKID SCAM

Here is how they work:

You get a call: "Grandma, I need money for bail." Or money for a medical bill. Or some other kind of trouble. The caller says it is urgent and tells you to keep it a secret.

But is the caller who you think it is? Scammers are good at pretending to be someone they are not. They can be convincing: sometimes using information from social networking sites, or hacking into your loved one's email account, to make it seem more real. And they will pressure you to send money before you have time to think.

Here is what you can do:

Stop. Check it out. Look up your grandkid's phone number yourself, or call another family member.

IRS IMPOSTER SCAMS

Here is how they work:

You get a call from someone who says she is from the IRS. She says that you owe back taxes. She threatens to sue you, arrest, or deport you, or revoke your license if you do not pay right away. She tells you to put money on a prepaid debit card and give her the card numbers.

The caller may know Social Security number. And your caller ID might show a Washington, DC area code. But is it really the IRS calling?

NO. The real IRS will not ask you to pay with prepaid debit cards or wire transfers. They also will not ask for a credit card over the phone. And when the IRS first contacts you about unpaid taxes, they do it by mail, not by phone. And caller IDs can be faked.

Here is what you can do:

Stop. Do not wire money or pay with a prepaid debit card. Once you send it, the money Is gone. If you have tax questions, go to irs.gov or call the IRS at 800-829-1040.

CHARITY FRAUD

Here is how it works:

Someone contacts you asking for a donation to their charity. It sounds like a group you have heard of, it seems real, and you want to help.

How can you tell what charity is legitimate and what is a scam? Scammers want your money quickly. Charity scammers often pressure you to donate right away. They might ask for cash, and might even offer to send a courier or ask you to wire money. Scammers often refuse to send you information about the charity, give you details, or tell you how the money will be used. They might even thank you for a pledge you do not remember making.

Here is what you can do:

Take your time. Tell callers to send you information by mail. For requests you get in the mail, do your research. Is it a real group? What percentage of your donation goes to the charity? Is your donation tax-deductible? How do they want you to pay? Rule out anyone who asks you to send cash or wire money. Chances are, that is a scam.

EMPLOYMENT SCAMS

Here is how it works:

Someone contacts you and offers you a job, such as “work from home” and “earn thousands of dollars a month, no experience needed.” All the victim needs to do is fill out the employment form with all their personal information and send the new employer an initial job finder’s fee.

Here is what you can do:

Stop. Do not wire money or pay with a prepaid debit card. Once you send it, the money Is gone.

CAR WRAP SCAMS

Here is how it works:

Have you seen ads promising easy money if you shrink-wrap your car – with ads from bonds like Monster Energy, Red Bull, Gatorade, or Pepsi? The company behind the ads says all you must do is deposit a check, use part of it to pay a specified shrink-wrap vendor, and drive around like you normally would.

Here is what you can do:

Do not jump on the bandwagon. It is only easy money for the scammer who placed the ads. The check he sent you is counterfeit and against the law to cash or deposit.

HEALTH CARE SCAMS

Here is how it works:

You see an ad on TV, telling you about a new law that requires you to get a new health care card. Maybe you get a call offering you big discounts on health insurance. Or maybe someone says they are from the government, and need your Medicare number to issue you a new card.

Scammers follow the headlines. When it is Medicare open season, or when health care is in the news, they go to work with a new script. Their goal? To get your Social Security number, financial information, or insurance number.

So, take a minute to think before you talk: Do you really have to get a new health care card? Is that discounted insurance a good deal? Is that “government official" really from the government? The answer to all three is almost always: No

Here is what you can do:

Stop. Check it out. Before you share your information, call Medicare (1-800-MEDICARE), do some research, and check with someone you trust. What is the real story!